Any individual or business that is overwhelmed with debt is receiving complex and confusing information from many angles. Debt consolidation companies may be contacting you. Creditors may threaten you. Payday loans and debt buying agencies may be tempting you to use their services.

In the vast majority of cases, bankruptcy is the most viable option for solving debt issues. Rather than getting a second job, draining valuable savings accounts (particularly retirement savings) or entering into more debt with predatory lending agencies, get the information you need from the Law Offices of Thomas P. Kelly III.

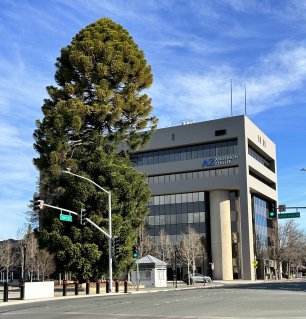

For decades, Thomas P. Kelly III has worked with people throughout Sonoma County, California, helping them overcome the stress and uncertainty of financial problems with reasonable and responsible solutions in bankruptcy. Every case is given individualized attention, meaning we will only recommend bankruptcy if it is truly what our experience has proven to be effective for individuals like yourself.

To reach an experienced lawyer who can walk you through the bankruptcy process with confidence,

Important Things To Consider Before You File For Bankruptcy In The Santa Rosa Area

If you are unable to pay your bills, and debt keeps piling up, then you are, essentially, already bankrupt. The challenge you face now relates to whether you are prepared to declare it with the bankruptcy court.

How do you know if filing for bankruptcy is right for you? Some key details to consider are:

Email [email protected] | First consult is always free | 707-545-8700