Many creditors fall into harassing behaviors, whether by calling incessantly, calling at inappropriate times or explicitly threatening debtors. The Fair Debt Collection Practices Act (FDCPA) regulates the manner in which creditors contact debtors to collect on unpaid debts, protecting debtors from such inappropriate behavior.

Unfortunately, many debtors are unaware of their rights and fall victim to these practices anyway. I have handled numerous cases where creditors are harassing my client after they file bankruptcy. From the moment you file, correspondence from creditors must go through your attorney directly, meaning you get immediate relief from the phone calls and letters that are causing you stress.

Furthermore, if we find any creditor to be in violation of these FDCPA rules and regulations, we may pursue legal action on your behalf.

Stop Debt Collection Calls

The Fair Debt Collection Practices Act (FDCPA) is a federal law that regulates what creditors can do to collect unpaid debt. For those in California, the California Fair Debt Collection Practices Act (CFDCPA) also regulates these actions.

The CFDCPA covers more types of creditors and offers more protection to debtors than the federal law alone.

Under these laws, a creditor is required to:

- Avoid using threats or unlawful conduct to try to make you pay. No creditor or debt collector may legally threaten or intimidate you with physical force, criminal tactics or claiming that you are a criminal for not paying debt. Furthermore, threats that involve seizing property can only be made if the creditor has legal right to do so and plans on taking that action.

- Only communicate with you in a certain manner. Creditor or debt collectors must identify themselves as such when contacting you and may not use obscene or aggressive language when discussing the debts you owe. They may not call you repeatedly to annoy you, call you at odd hours, or disclose information about your debt to others.

- Respect and protect your privacy. A creditor may contact those around you, such as your friends, family or employer to locate you, but may not disclose information about your debt to these people or organizations. A creditor may not publish your name and the amount of debt you owe, and any correspondence from a creditor must be in a sealed envelope that does not showcase your debt information.

- Accurately represent itself as a creditor or debt collector. Creditors must be clear about who they are. They cannot claim to be attorneys, nor can use law firm stationery if the documents are not coming directly from a law firm. They also cannot represent themselves as credit reporters or threaten to report you if unless they are actually going to do so.

- Not contact you if you are being represented by an attorney. When you work with a bankruptcy attorney, he or she will inform your creditors of your representation and instruct them to send all correspondence to the law firm that represents you. If they fail to do so they are in violation of FDCPA.

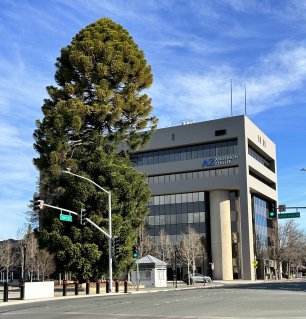

Email [email protected] | First consult is always free | 707-545-8700