In bankruptcy, an exemption means a specific kind of property which is "exempt" from seizure or liquidation by the bankruptcy trustee or creditors.

Exemptions are controlled by the laws of the State in which you live, and in California there are two sets of bankruptcy exemptions under C.C.P. 703 and C.C.P. 704.

C.C.P. 704 is used where you own a home, and have equity in that home. The amounts vary depending on your circumstances. An individual or married couple with no one else living in the house (such as children) can claim $75,000 in equity as exempt.

If you are married and have children that amount increases to $100,000. If you are over 65 years old, that amount is increased to $175,000. There are other applicable exemptions under C.C.P. 704, but you should give me a call to talk about those.

C.C.P. 703 is used where you do not own a home, or you have no equity in that home. Under C.C.P. 703 it creates what is called a "wildcard" exemption which allows you $25,000 of exemption which can be applied to anything you own. Cars, boats, artwork, electronics, or any other property you own.

There are numerous other exemptions for equity in a car, tools you use in your work, some jewelry, and others too numerous to list here.

An important exemption that applies to all cases is for retirement accounts, IRAs, college savings accounts, and health savings accounts. These are all 100% exempt. So if you are considering taking money out of one of these accounts to make it through the month, DO NOT TOUCH IT. You will not only have to pay back the money you take out, but there are harsh tax penalties on top of that. If you are considering this, it is time to send me an email or give me a call at 707-545-8700

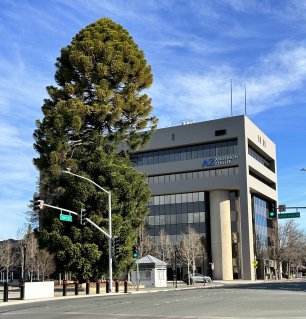

Email [email protected] | First consult is always free | 707-545-8700